|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Should I Refinance My FHA Mortgage: Key Considerations and BenefitsDeciding whether to refinance your FHA mortgage can be a significant financial decision. Understanding the pros and cons, and knowing when it might be beneficial, are crucial steps in this process. Understanding FHA RefinancingWhat is FHA Refinancing?FHA refinancing involves replacing your current FHA mortgage with a new one. This can be done to achieve better terms or lower interest rates. Types of FHA Refinancing Options

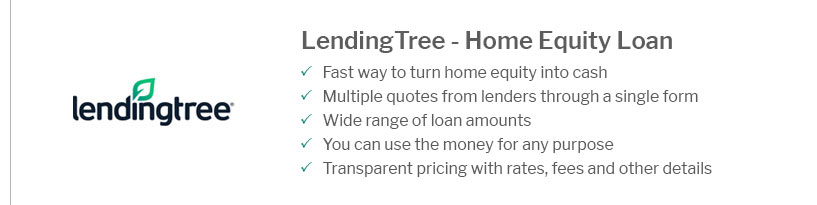

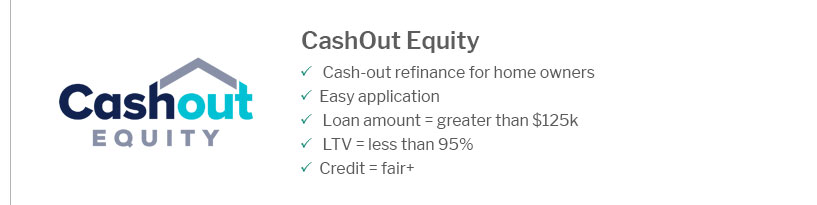

Benefits of Refinancing an FHA LoanLower Interest RatesOne of the primary reasons to refinance is to secure lower interest rates. This can significantly reduce monthly payments and overall interest costs. For current rates, check out refinance home loan interest rates. Removing Mortgage Insurance PremiumRefinancing can help you eliminate the Mortgage Insurance Premium (MIP) if you switch to a conventional loan and meet certain equity requirements. Accessing Home EquityWith a cash-out refinance, you can access the equity built in your home, which can be used for other financial needs such as renovations or debt consolidation. Potential Drawbacks of RefinancingClosing CostsRefinancing involves closing costs, which can be between 2% and 5% of the loan amount. It's important to calculate if the savings from a lower interest rate will offset these costs. Longer Loan TermsRefinancing to a new 30-year loan can extend your mortgage term, which may not be beneficial if you're close to paying off your current loan. FAQ: Common Questions About FHA Refinancing

https://www.lendingtree.com/home/refinance/refinance-fha-loan-to-conventional/

To shorten your loan term. - To get rid of mortgage insurance. - To reduce how long you'll have to pay for mortgage insurance. - To borrow a higher loan amount ... https://money.usnews.com/loans/mortgages/articles/can-you-refinance-an-fha-loan

You can refinance your FHA loan, but make sure your closing costs don't eat too much into your savings. By Kim Porter. https://www.rocketmortgage.com/learn/fha-refinance

It's possible to refinance an FHA loan into a conventional loan. Homeowners may choose to do this to avoid paying a mortgage insurance premium ( ...

|

|---|